PG&E Warns Customers of an Emerging Scam Campaign and Provides Tips on How Customers Can Protect Themselves

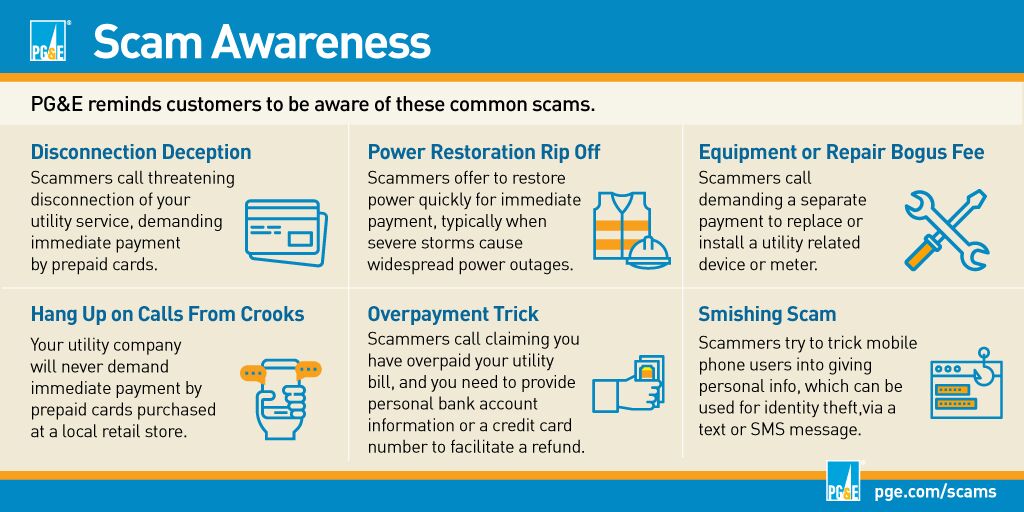

In recent weeks, PG&E has received dozens of reports on an emerging scam: utility impostors demanding immediate pament for a SmartMeter deposit to avoid disconnection. As the number of these scam attempts targeting utility customers continue at an alarming rate, PG&E wants to help customers recognize the signs of a scam so that they can avoid falling victim.

In this latest scam campaign, scammers are contacting customers via both email and phone, falsely telling them that their utility meter needs to be replaced and that immediate payment of a deposit is required to avoid disconnection.

“Scammers are constantly changing their tactics to target unsuspecting victims, and this latest scam campaign is another example of that. Please remember, if you receive a call from someone claiming to represent PG&E who is threatening disconnection if you do not make immediate payment, just hang up and call PG&E at 1-833-500-SCAM or log into your PGE.com account to confirm your account details and balance. PG&E will never ask for you for your financial information over the phone or via email nor will we request payment via pre-paid debit cards or other payment services like Zelle,” said Aaron Johnson, PG&E Bay Area regional vice president.

And while this trend is spiking, it is only part of an increased number of scam reports seen by PG&E during 2022. Year to date, PG&E has received more than 7,200 reports from customers who were targeted by scammers impersonating the company, marking a dramatic increase over 2021 when there were just over 11,000 reports for the entire year. In 2021, PG&E customers lost over $600,000 to scammers. Callers claiming to represent PG&E requesting payment via a pre-paid debit card or payment service like Zelle should be a red flag for customers.

Scammers are opportunistic and look for times when customers may be distracted or stressed, as has been the case during the COVID-19 pandemic. During this time, scammers have increased calls, texts, emails and in-person tactics, and they are constantly contacting utility customers asking for immediate payment to avoid service disconnection. As a reminder, PG&E will never send a single notification to a customer within one hour of a service interruption, and we will never ask customers to make payments with a pre-paid debit card, gift card, any form of cryptocurrency or third-party digital payment mobile applications.

Scammers can be convincing and often target those who are most vulnerable, including senior citizens and low-income communities. They also aim their scams at small business owners during busy customer service hours. However, with the right information, customers can learn to detect and report these predatory scams.

Signs of a potential scam

Threat to disconnect: Scammers may aggressively demand immediate payment for an alleged past due bill.

Request for immediate payment: Scammers may instruct the customer to purchase a prepaid card and then call them back supposedly to make a bill payment.

Request for prepaid card: When the customer calls back, the caller asks the customer for the prepaid card’s number, which grants the scammer instant access to the card’s funds.

Refund or rebate offers: Scammers may say that your utility company overbilled you and owes you a refund, or that you are entitled to a rebate.

How customers can protect themselves

Customers should never purchase a prepaid card to avoid service disconnection or shutoff. PG&E does not specify how customers should make a bill payment and offers a variety of ways to pay a bill, including accepting payments online, by phone, automatic bank draft, mail or in person.

If a scammer threatens immediate disconnection or shutoff of service without prior notification, customers should hang up the phone, delete the email, or shut the door. Customers with delinquent accounts receive an advance disconnection notification, typically by mail and included with their regular monthly bill.

Signing up for an online account at pge.com is another safeguard. Not only can customers log in to check their balance and payment history, but they also can sign up for recurring payments, paperless billing and helpful alerts.

Scammers Impersonating Trusted Phone Numbers: Scammers are now able to create authentic-looking 800 numbers which appear on your phone display. The numbers don’t lead back to PG&E if called back, however, so if you have doubts, hang up and call PG&E at 1-833-500-SCAM. If customers ever feel that they are in physical danger, they should call 911.

Customers who suspect that they have been victims of fraud, or who feel threatened during contact with one of these scammers, should contact local law enforcement.

For more information about scams, visit www.pge.com/scams.